Get value from your Transfer Pricing Data

ValuePricing's data platform provides you with all the tools to create consistent, customizable and data-enabled transfer pricing analyses. Create a single source of truth with the TP data management Module, calculate the relevant metrics and share the reports with your findings.

Use cases

Use casesUse data during planning, implementation and monitoring of your transfer pricing policies

Design and evaluate TP policies

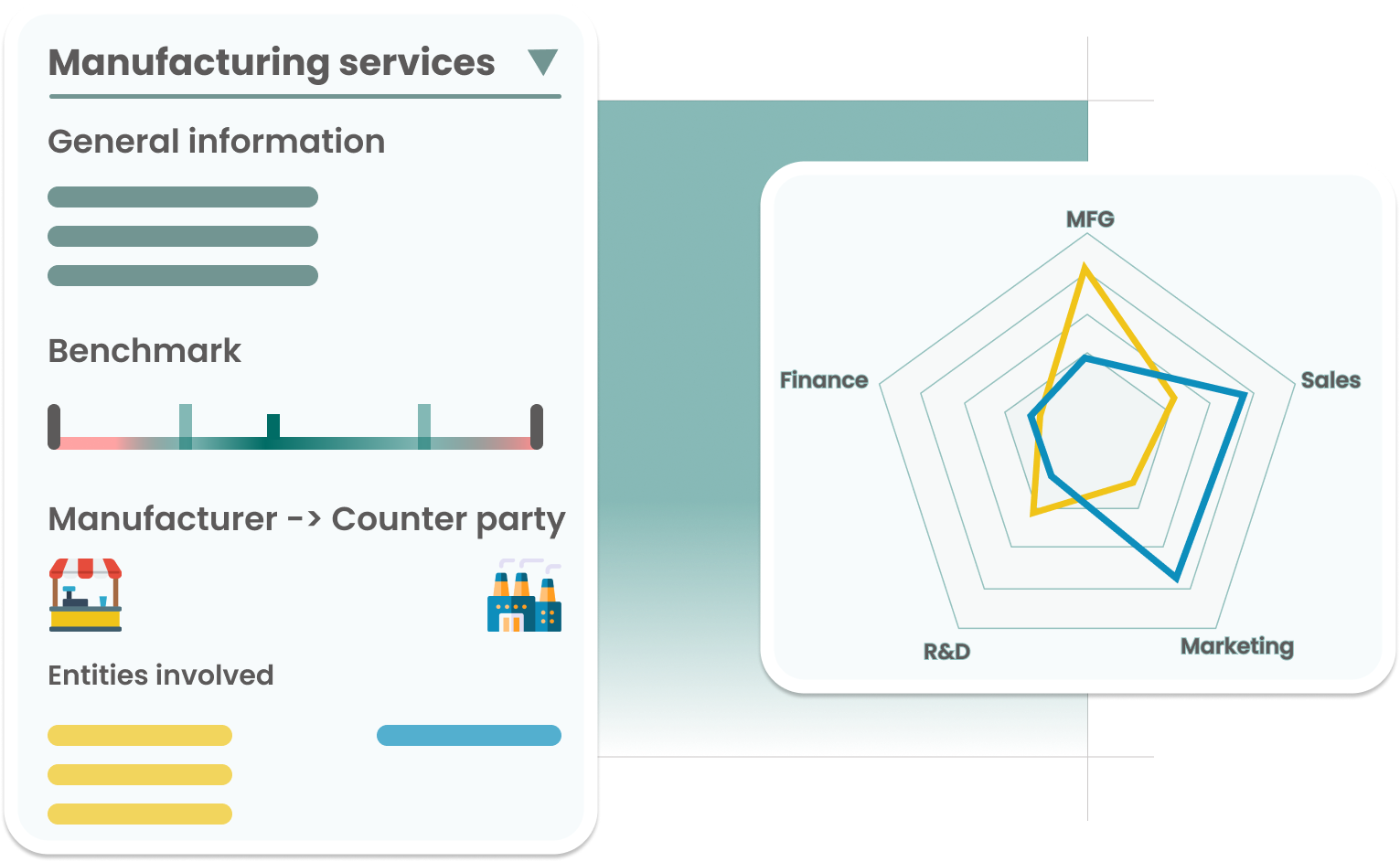

With our streamlined data collection and mapping process, you can identify the key functions and risks associated with each transaction, making it easier to design and evaluate your transfer pricing policies. By taking a holistic approach to transfer pricing, you can ensure that your policies are aligned with your overall business strategy and goals. Convinient as a tax director and a big time saver for tax advisors.

Operational control (OTP) and documentation

Operational transfer pricing requires continuous monitoring of functionality and margins, which can be a time-consuming and difficult task. With our platform, you can track your transfer pricing data on a contious basis and see when thresholds are exceeded. This makes it easier to ensure that your transfer pricing remains compliant and effective.

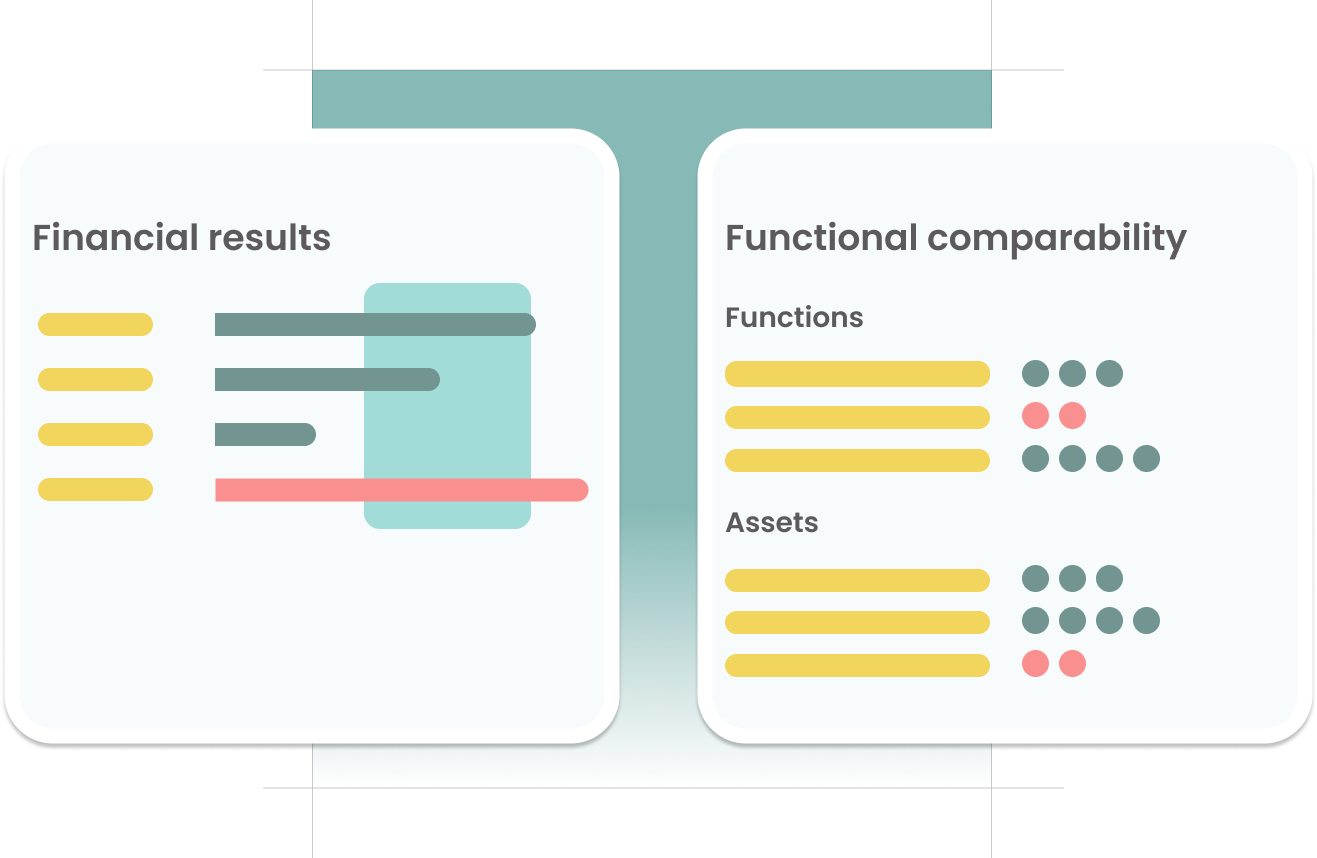

With all relevant data at your fingertips, you can feel confident in your transfer pricing decisions and be prepared for any potential audits.

Tax transparancy and risk assessments

Using our platform not only simplifies your transfer pricing process, but it also promotes transparency and accountability. As countries around the world implement public country-by-country reporting (CbCR) requirements, it's becoming increasingly important to ensure your transfer pricing practices are transparent and well-documented.

With our platform, you can easily generate clear and concise reports to support your transfer pricing decisions, making audits and public CbCR requirements less stressfull and time-consuming.