Transfer pricing in control through data

ValuePricing's platform enables tax managers and advisors to support TP policies with data, thereby improving the consistency, reliability and cost-effectiveness of their transfer pricing processes.

TP Data Platform

TP Data PlatformFrom Paper Based to Data Based

In today's world, organizations dedicate substantial resources to the design, testing, and explanation of transfer pricing policies, often relying on extensive qualitative analyses and troubled data. Our platform can help to improve the efficiency of your transfer pricing operations, by offering a streamlined way to organize TP-centric data, calculate relevant metrics and share the reports.

TP Data Management

Gathering, organizing and segmenting data is fundamental to efficient TP processes. Our platform helps you to do this in a structured way with version control and clear audit trails.

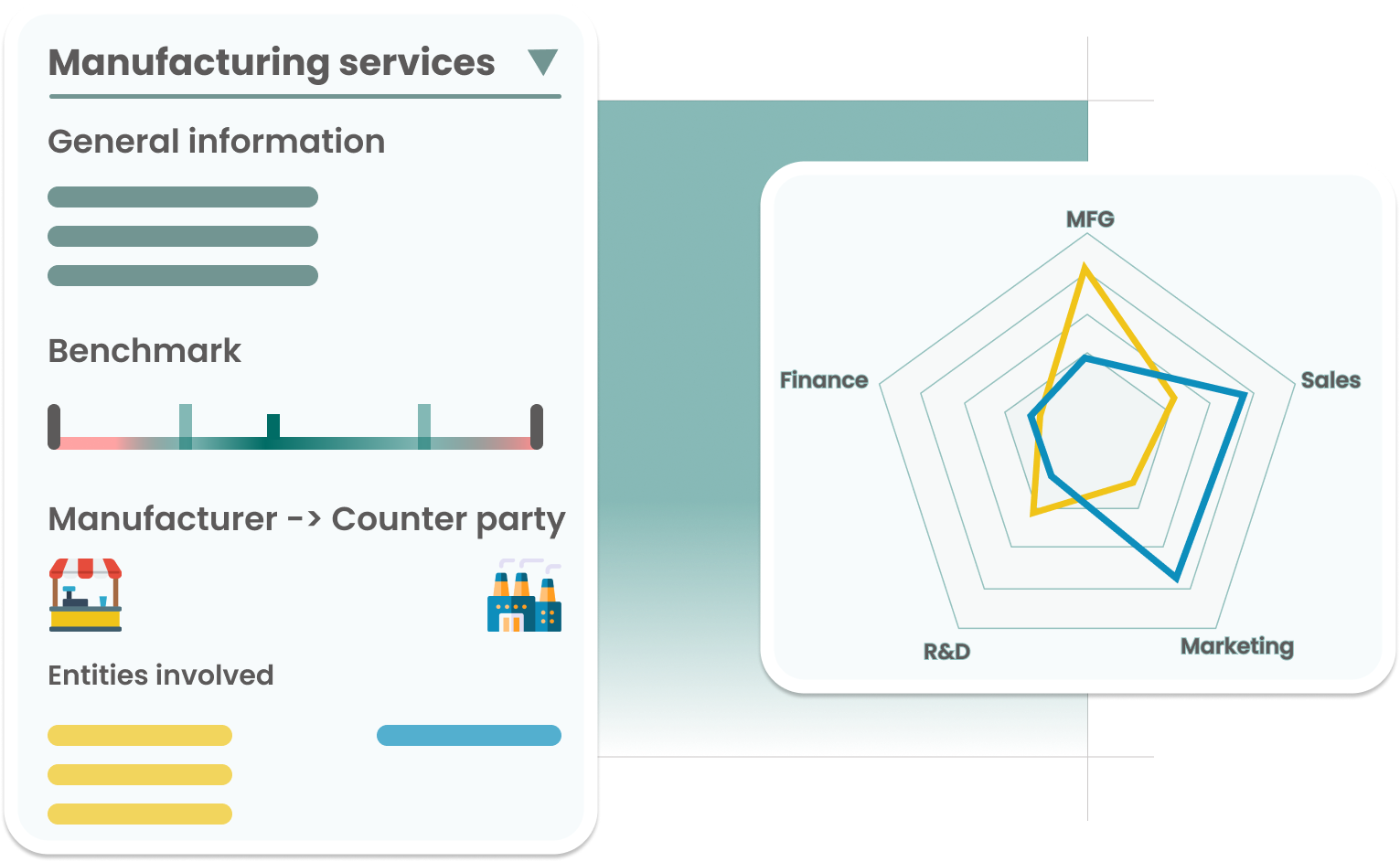

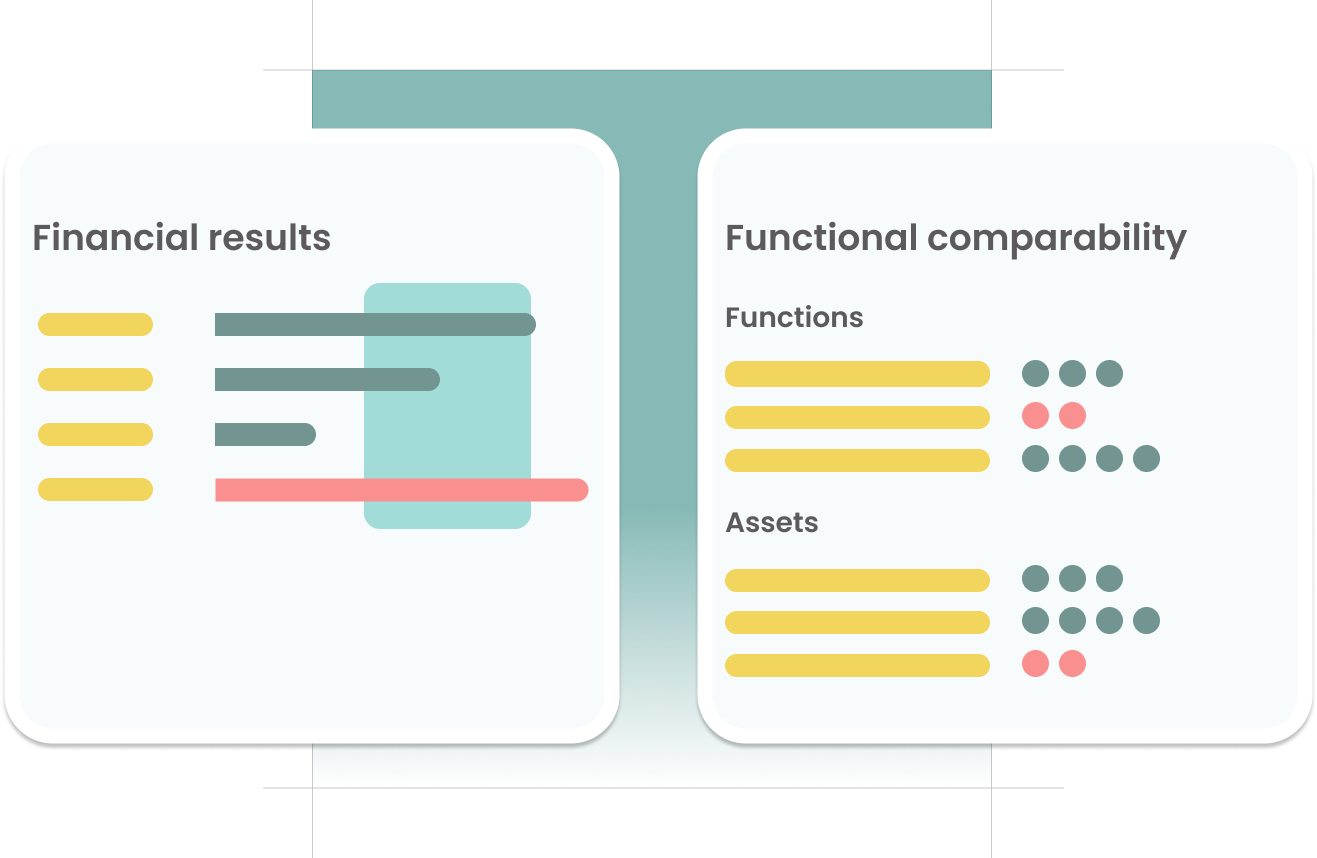

TP Calculation Engine

The functional, comparability and financial analyses can greatly benefit from the use of data, but lack of time often holds this back. Our platform enables you to instantly calculate the relevant metrics for your model.

Later more

Report and Share

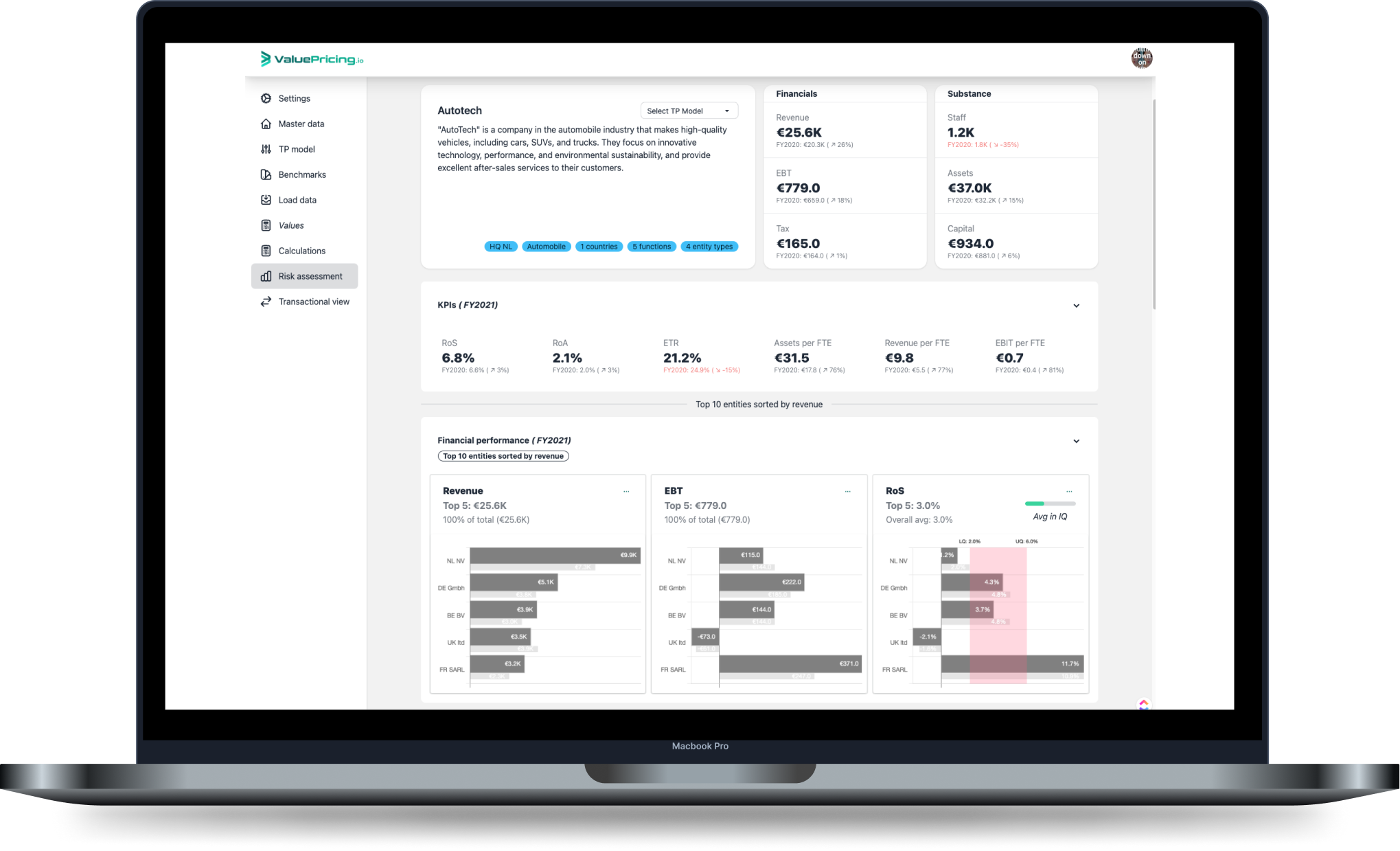

With our reporting module you can filter, sort, and modify dashboards to get the insights you need. Once you're done, you can can share the report with your findings, along with the underlying data, with your stakeholders.

Applications

ApplicationsEnabling Data-Driven Transfer Pricing Analyses

Leveraging the tools and data from our TP Data Platform, you can instantly create comprehensive transfer pricing reports. This empowers you to sustain control, conduct risk assessments, and make more insightful decisions about your transfer pricing policies.

Prepare for what's coming with the Enhanced CbCR Risk Analyzer

The CbCR Risk Analyzer uses enriched multi-year CbCR data Public CbCR and insightful visuals to help you understand patterns and risks, identify inconsitencies and assess the impact of pillar 2.

Read moreBecome Audit-Ready with the Segmented TP Model Risk Assessment

The segmented TP model risk assessment allows you to perform quantative functional analyses to validate your TP model baed on Segmented financial and non-financial data. This allows you to determine and support the funtional profile of routine entities so you can focus on the more sensitive parts of your TP model.

Read more

Model the Impact of Pillar 2 (light version)

The Pillar 2 Impact Analzyer calculates which countries might be affected by a top-up tax based on enriched CbCR data. Future enhancements to this model will determine which countries are liable to pay this top-up tax.

Read more Use cases

Use casesBenefit from your Transfer Pricing Data

Our platform and analyses can be employed at various stages of the TP process - from initial design and operations to documentation and audits. The platform's flexibility allows for diverse use, whether you're a tax manager, advisor or auditor.

Better TP Design

Ensure alignment of your policy with the data to prevent inconsistencies.

Read moreOperational TP and Documentation

With all the relevant data points and metrics at your fingertips, monitoring and documenting your policies becomes easier.

Read moreTransparency and Risk Assessment

Demonstrate control and get high-level understanding of TP policies with data-driven reports.

Read more Our vision and mission

Our vision and missionTogether we can turn Transfer Pricing into Value Pricing

With our transfer pricing data platform we want to provide organizations with a way to make transfer

pricing processes more transparant and data-enabled. We believe this more objective approach can

bring significant value to the tax function: it can reduce disputes, lower risks, and make audits

less painful. Moreover, these analyses can provide valuable insights for business improvement and

foster societal understanding of a company's tax contributions in different countries.

Read more

Get started

Get startedGet started today! Request a demo here.

Would you like to try the power of data with our platform? We can deliver a multi-year

CbCR analysis or a data-driven assessment of your (clients) TP models within a day.

Contact us below to request an analysis or schedule a demo.

As a new company, we are excited to evolve the platform in response to your unique needs.

Whether you're seeking specific insights or solutions to your data challenges, we invite

you to collaborate with us and improve the control over transfer pricing!